Ready to sell your home? Getting all your paperwork and documents in order is a crucial first step to streamline the process. Ensure you have everything ready before potential buyers come knocking. Read our guide which tells you exactly what the documents needed to sell a house in the UK are.

Why Documentation is Crucial for Home Selling

Documentation is the foundation of a successful property sale. It not only ensures legal compliance but also builds trust with potential buyers. Missing or incomplete paperwork can lead to delays, reduced offers, or even failed transactions. Whether you’re selling a freehold or leasehold property, having everything organised early can save you stress on completion day.

For tips on enhancing your property’s value before selling, check out our guide on how to add value to your home.

Documents needed to sell a house

Identity

- Proof of identity. Estate agents and solicitors must comply with money laundering rules, and will want you to prove who you are. Show them your passport, your driving licence, or your birth certificate, and have proof of address. You’ll also need to complete an ID1 form before the exchange of contracts occur on a property transaction.

- Title deeds. These prove you own the home you’re selling, and show its boundaries. Your solicitor or mortgage provider should be able to help you find the deeds you need, including a TR1 form. Alternatively, you can buy an ‘Official Copy Entry’ of your home’s title register and floor plans from the HM Land Registry website for £3.

- Management Information Pack. If your property is leasehold, or if you pay service charges, you might need a Management Information Pack from your solicitor. (sometimes called a Leasehold Information Pack). Arranging this can take time, so ask for this early.

Certificates

- EPC (Energy Performance Certificate). No dodging this one – it’s compulsory. It says how much energy your home uses, and what CO2 it emits. Your EPC should be less than ten years old. Your estate agent can help, or you can ask for an EPC here. In Scotland you’ll need a home report which must be less than 10 weeks old.

- Gas Safe Certificate. Not compulsory but highly recommended. Have an annual gas safety inspection carried out by a registered gas safety engineer. Again, do this as early as you can. Your conveyancer can help. You can get a replacement gas safe certificate from the Gas Safe Register.

- Boiler Safety Certificate. If you have a boiler, but no boiler safety certificate, your house sale won’t go ahead. You need a valid boiler safety certificate and a Building Regulations Compliance Certificate. This should show when the boiler was installed, and certifies it was installed properly, and meets all necessary regulations. Contact the Gas Safe Register if you need a replacement.

- Electrical Safety Certificate. You’ll need an electrical certificate to sell your house. It proves any electrical installation works done on your home followed current building regulations. If you don’t have one, see if your local authority has a copy, or ask a ‘Part P registered electrician’ to re-do the work, or call in a qualified electrician. You’ll want an Electrical Installation Condition Report, or EICR.

- FENSA or CERTASS Certificate. This covers any doors or windows you’ve added, and it’ll show the installation meets current building standards. The installer should have left you a certificate, or you can order replacements from the FENSA site. CERTASS is an alternative certification that focuses more on the whole building.

Information

- Property Information Form (TA6). This questionnaire gives your buyers essential information about your house. It can say who is responsible for hedges or fences. It can cover warranties you have on solar panels, or say where your meters are, and what parking you have. Download this from the Law Society’s website.

- Fittings and Contents Form (TA10). This says what’s included in the sale. It can cover garden sheds, furniture, ornaments, or even trees. Again, it’s available from the Law Society’s website.

- Property Searches. The buyer usually pays for these, but ordering them early can speed up your sale. The first is a local authority search which covers planning and pollution issues. The second covers environmental matters on areas like flooding or contaminated land. There’s also a ‘Water and Drainage’ search which asks the local water company who owns and maintains the property’s sewers and drains, etc. Your conveyancer can give you more information.

- Planning documents. Did you add a conservatory or a study to your home? Buyers need to know those alterations were carried out properly. Google ‘Planning Portal’ and your local authority’s name, and search for your address. Download the relevant documents, share them with your estate agent, and add them to your file.

- Other documents. Are floods common in your area, or is your home of non-standard construction? Does your home have a short lease, or are there restrictions on its use? List anything which could affect your home.

- If your home is less than 10 years old, include a copy of your Buildmark or any other warranty documents.

Finance

- Remaining Mortgage Details. Still paying your mortgage? You’ll need to list what you still owe. Any additional loans linked to your home should be outlined too. You must promise to pay off any outstanding loans to stop the buyer becoming liable

- Receipts. Find receipts or guarantees for any work you’ve had done. The same goes for any electrical goods or fixtures and fittings you’re leaving behind.

- Memorandum of Sale (MOS). This lists the acting conveyancers and says who is buying and selling. Your estate agent will usually prepare this, but once you accept an offer, ask them if they have all the information they need to complete the MOS. Don’t be afraid to badger them to speed up your sale.

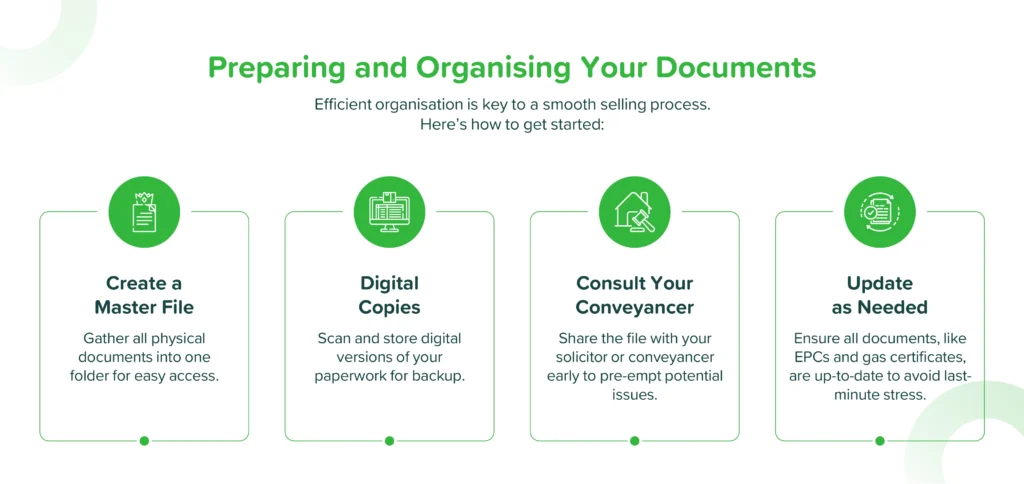

Preparing and organising documents

Spend a few hours assembling a single folder holding every document your buyer might want. Keeping everything together can save you days of hassle.

You’ll want to keep these documents safe, but also have them easy to access. A ring binder or a box file can hold everything and you can label this ‘Home Sale Documents’ or similar.

Sort your documents into the above categories, such as ‘Finance’, ‘Property’ or ‘Certificates’, to help buyers find what’s needed. A fire safe can protect these vital documents.

Got a scanner? Store electronic copies of your documents on a hard drive or on the cloud, and share copies with potential buyers. If you want to learn more about how you can add value to your home, check our our helpful guide with our top tips, no matter the budget.

Leasehold Documents: What You Need to Know When Selling a Leasehold Property

Selling a leasehold property comes with its unique requirements. One of the most crucial steps is providing a copy of the lease. This document outlines the legal agreement between you (the leaseholder) and the freeholder, detailing your rights, obligations, and any restrictions.

Why are the Leasehold documents Important?

Potential buyers need to understand the terms of the lease before committing to the purchase. This includes:

- Lease duration: Buyers prefer leases with a long remaining term (ideally 80 years or more).

- Ground rent and service charges: These ongoing costs can impact affordability and buyer interest.

- Restrictions or obligations related to the property.

Failing to provide these details can delay the process or deter buyers altogether.

Key Documents to Prepare

When selling a leasehold property, ensure you gather and organise the following early:

- Copy of the Lease: This is the cornerstone document buyers and their solicitors will review.

- Service Charge Statements: Provide a record of recent and upcoming charges.

- Ground Rent Details: Include evidence of payments and any increases outlined in the lease.

- Share Certificate: If the property includes a share of freehold, ensure this document is available.

- Management Company Correspondence: Include documents from the management company, such as notices about repairs or maintenance.

- Buildings Insurance Policy: Most lease agreements require proof of a valid policy.

- External Wall Fire Review (EWS1 Form): For flats, especially post-Grenfell, this document may be required to confirm the safety of cladding.

Common Issues and Resolutions

If there are unresolved disputes or past issues (e.g., unpaid service charges or maintenance complaints), provide documentation of their resolution. Transparency builds trust and prevents delays during leasehold conveyancing.

Planning Permission and Building Regulation Certificates

If your property has undergone any alterations or extensions, you’ll need the relevant planning permission and building regulation certificates to sell it. These documents prove the work complies with legal and safety standards, reassuring buyers and their lenders.

Why Are These Documents Essential?

- Legal Compliance: Unapproved work could lead to fines or legal action for the buyer.

- Buyer Confidence: Missing certificates can deter buyers or reduce offers.

- Mortgage Approval: Lenders often require proof that all alterations meet building regulations.

Documents to Provide

- FENSA Certificate: For replacement windows and doors.

- NHBC Certificate: For new builds, covering structural warranties.

- Part P Building Regulation Certificate: For electrical work.

- Completion Certificates: For larger projects like extensions.

- Conservation Area Consent Forms: If the property is in a designated conservation area or is a listed building, include special consent forms.

What Happens If These Are Missing?

If you don’t have the necessary certificates, buyers may request an indemnity policy. This is an insurance policy that covers future enforcement by local authorities for unapproved work. However, it’s better to have the original documents ready to avoid delays or added costs.

Additional Considerations

- For illegal additions, consult a conveyancer to determine the best course of action.

- Provide service records for appliances, such as boilers, to show proper maintenance.

- Ensure planning documents are up-to-date to avoid surprises during the buyer’s local authority search.

Organising for a Smooth Sale

Proactive organisation of your leasehold documents, planning permissions, and building regulation certificates sets the tone for a smooth property sale. Buyers appreciate transparency, and having everything ready can shorten timelines and increase trust.

For more guidance on timing your sale, check out when is the best time to sell a house.

Summary

Having everything in place will make selling far smoother and enjoyable. Selling your home is stressful enough, but you can avoid any last-minute panic and scramble by having everything in place before you meet potential buyers. If you can, pull the paperwork together as soon as possible, so you have everything ready the moment prospective buyers come calling.

Looking to sell your house quick? Perhaps your house sale has fallen through, or you’re looking to sell house after a divorce. Whatever the reason, Zapperty will give you a free cash offer within 60 minutes and have your sale completed within a week. Learn how Zapperty works so you can get your free cash offer and provide all the relevant documents needed to sell a house fast.