When it comes to house prices in 2024, things appear to have ground to a halt. According to the Office of National Statistics, average house prices have grown just 0.6% in England compared with last year. But despite this, it was only last year that house price predictions forecasted up to a 15% fall in 2024.

So if you’re asking will there be a housing market crash or will house prices go down in 2024, so far, the answer is – we don’t know. Sure, the market has not yet seen the kind of wobble we experienced in 2008/9, but there is still some real uncertainty in the system. In this guide, we explore housing market crashes, why they might happen, the warning signs and strategies .

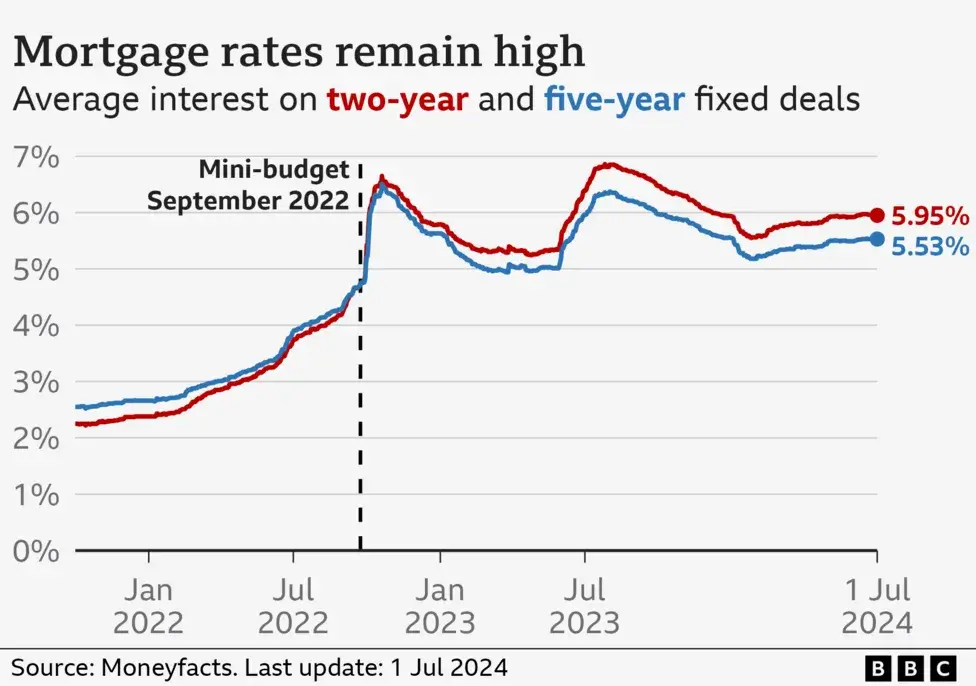

Let’s look at the numbers…

Yes, inflation has come back to 2% for the last two months, but mortgage interest rates remain locked because wage inflation remains high. However, as stability returns to wage growth, the housing market may start to feel the pinch of the cost of living crisis.

According to Forbes “Asking prices have been largely static over the past 12 months as the market has been affected by higher mortgage costs”. This means that what people can expect to get for their property has stagnated somewhat. The Bank of England also stated that mortgage payments for 3M households will rise in the next two years.

Source: BBC

Why does the housing market crash?

Housing market crashes are typically caused by unsustainable financial structures gaining influence. The easier credit is, the more likely people will borrow more that they can afford. These unqualified buyers – in sufficient numbers – trigger defaults that flood the market, supply exceeds demand and prices plummet.

Today, far stricter lending helps prevent this. But economic downturns or high-interest rates can still cause a housing market slowdown. Meanwhile, the market could feel a little stagnant.

How is today different from the 2008 housing market crash?

- More demand – Unlike the 2008 crash, today, there’s actually a shortage of good houses available for sale. This means that demand is still good, so that limits how much prices could fall.

- Strong Equity – Many homeowners have significant equity in their homes, meaning they wouldn’t be in negative equity (owe more than the house is worth) even with a price dip. This reduces forced selling, another crash accelerant.

- Interest Rates – While these are high compared to the last decade, they have not reached the unsustainable levels seen before the 2008 crash.

What are the warning signs of a housing market crash?

Despite a flatlined housing market, other costs are still rising – in particular food and services like insurance. Despite an overall 2% inflation rate, the Office of National Statistics reported that prices of food and non-alcoholic beverages still rose by 7.0% in the year to January 2024.

While numerically the UK has reasonable housing levels, the Resolutions Foundation recently reported that households in Britain are paying more for less, and that our housing stock offers the worst value for money of any advanced economy. People are being expected to pay more, for a lot less.

The sustained high interest rates has also put a dampener on the housing market, preventing a crash, but rendering some locations and housing types difficult to shift, locking people into long chains and causing people to drop out of sales.

What about a recession?

Although we got close, it looks unlikely that we will have a true recession – at least not as deep as the one that followed the 2008 financial and housing market crash. But while smaller recessionary pressures might not affect larger markets like London or Manchester, less desirable localities will struggle. Read our guide on the most affordable places to live in the UK to understand which locations still have plenty to offer but won’t break the bank – if you are considering moving.

Planning a move? Download our free UK moving home checklist to stay organised from start to finish.

Will house prices be impacted by the recent general election?

The new Labour government is unlikely to make big decisions quickly. There will be no Truss mini-Budget moment! Labour will be changing the nil rate band for stamp duty back to £300,000 in April next year and may make it easier to secure a deposit. Overseas buyers are set to pay an extra 1% stamp duty surcharge. So, it is clear that what happens next to mortgage rates is going to have a bigger impact on the UK housing market in 2024 than anything so far announced by Labour.

What should you do if you need to sell your property now?

When financial times are difficult, a lot of the more everyday complexities gain influence. The cost of surveying, solicitors, and conveyancing is still on the rise. According to Which these costs have gone up 21% year on year. This can slow the market down as people struggle to afford fees, save for deposits and make the kinds of repairs and renovations typically carried out prior to putting property on the market.

As the market slows, the more desirable properties become scarce, chains become extended and more volatile. A single sale that falls through can cause the whole chain to break – with little chance of it re-establishing quickly. Have you experienced a house sale fallen through? Explore your options with Zapperty.

Strategies for sellers in an uncertain market

It is better to opt for certainty, than leave yourself open to the volatile and unpredictable housing market.

With fees and taxes on the rise, and the time taken to complete costing more and more, it could be the smart move to get a deal done and dusted, get your money and make your move.

Benefits of selling with Zapperty

Escaping the chain and avoiding the fees of typical estate agents, solicitors and the rest can save you time, money and give you the return on your property you need right now – not in six to eight months time.

Zapperty gives you a high percentage of the market valuation for your property quickly, and with none of the fuss and bother of a typical sale. So you can avoid rising service charges and move quickly. Zapperty gives you security and certainty in a time when the housing market is unsure, stagnant and fraught with added unseen costs. Learn more about how Zapperty works and receive your free cash offer today.