When it comes to property, whether you’re buying, selling, renting, or investing, it’s often one of the largest financial transactions you’ll make. Unfortunately, the real estate market isn’t free from fraudsters who are ready to exploit unsuspecting individuals. Property scams in the UK are more prevalent than you might think, targeting homeowners, renters, landlords, and investors alike.

In this guide, we’ll walk you through the most common types of property scams, how to identify fraudulent practices, and steps you can take to protect yourself. Whether you’re navigating Facebook property listings or investing in what seems like a lucrative opportunity, being informed is your best defence.

What Are Property Scams?

A property scam involves deceitful or illegal tactics to gain money or assets from property-related transactions. Fraudsters may target buyers, sellers, landlords, or tenants, often aiming to steal money or property through false promises and deceitful tactics.

Why Awareness is Essential in Real Estate

The real estate market is fast-moving and competitive, which can make it a breeding ground for fraud. Without proper vigilance, individuals can lose significant amounts of money or even their homes. Whether you’re rushing to secure a rental or sell a property fast, the pressure can lead to overlooked details. Fraudsters rely on this urgency, disguising their scams as legitimate opportunities. Awareness is your first line of defence. By understanding how these scams operate, you’ll be better equipped to avoid them and safeguard your property.

Common Types of Property Scams

The real estate market in the UK is home to several types of scams, ranging from bogus rentals to fraudulent investments. Below, we break down the most common ones so you know exactly what to watch out for.

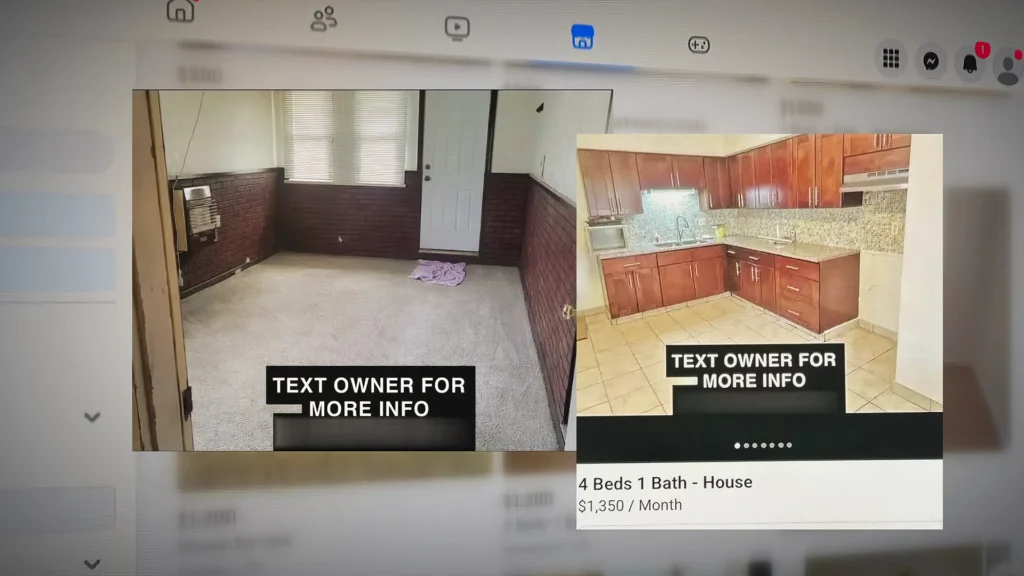

1. Facebook Property Rental Scams

Online platforms like Facebook have become popular for property listings, but not all offers are genuine. Fraudsters post attractive rental ads, luring tenants with low prices and fake promises.

Description and Examples

- A scammer advertises a stunning two-bedroom flat at half the market rate.

- They demand a deposit upfront to “secure” the property but disappear once the payment is made.

- Victims often find that the advertised property doesn’t exist or is already occupied.

Red Flags to Watch For

- Landlords or agents refuse to meet in person or show the property.

- Urgent demands for a deposit before viewing.

- Poor grammar or inconsistent details in the advertisement.

How to Avoid Falling Victim

- Always view the property in person.

- Never pay deposits via cash or untraceable methods.

- Verify the landlord’s identity through official channels, such as government-approved tenancy deposit schemes.

2. Property Investment Scams in the UK

Investment in property can be lucrative, but it’s also fertile ground for fraudsters who exploit the hopes of high returns. Many people are lured into these scams, often losing significant amounts of money.

Characteristics of Investment Fraud

Property investment scams often look legitimate at first glance. They use polished presentations, fake testimonials, and complex financial jargon to appear credible.

Here are key characteristics:

- Unrealistic Promises: Offers of guaranteed high returns with little or no risk.

- Pressure Tactics: Scammers push you to act quickly, claiming the opportunity is time-limited.

- Lack of Transparency: Vague or confusing details about the property or the investment process.

- Unregistered Companies: Operate without FCA (Financial Conduct Authority) regulation or proper documentation.

Case Studies and Statistics

- The Emerald Investment Scam: Investors were promised lucrative returns on luxury developments that didn’t exist. Victims lost over £20 million.

- Recent Data: In 2023, Action Fraud reported over 2,000 cases of property-related investment scams, costing victims an average of £15,000 each.

How to Protect Yourself

- Do Your Research: Verify company registration with the FCA (Financial Conduct Authority) and reviews.

- Seek Expert Advice: Consult legal or financial professionals before making commitments.

- Stay Skeptical: If it sounds too good to be true, it probably is.

3. Property Management Scams

Fraudsters often target landlords and tenants through fake property management services, leaving both parties vulnerable.

How These Scams Operate

- Scammers pose as professional property managers, offering to handle tenant relations, rent collection, and property maintenance.

- They collect rent from tenants but fail to pass it on to landlords.

- They might charge inflated fees or demand upfront payments for services they never provide.

Impact on Landlords and Tenants

- For Landlords: Loss of rental income, legal disputes with tenants, and damaged reputations.

- For Tenants: Confusion over payments and possible eviction due to unpaid rent.

How to Avoid This Scam

- Verify the credentials of property management companies.

- Use formal contracts to outline roles and responsibilities clearly.

- Regularly check on property-related transactions and communications.

Identifying Fraudulent Practices

1. Recognising Fake Estate Agents

Fake estate agents prey on buyers and sellers, exploiting their trust during property transactions.

Signs of a Fraudulent Agent:

- Unregistered with professional bodies such as The Property Ombudsman (TPO).

- No physical office or poorly maintained online presence.

- Upfront demands for fees before services are rendered.

Verification Methods:

- Check their membership with trusted organisations like TPO or NAEA (National Association of Estate Agents).

- Request to see proof of identification and licensing.

- Research reviews and ask for references from previous clients.

2. Understanding Rental Fraud

Rental fraud involves tricking tenants into paying deposits for properties that are unavailable or non-existent.

Common Tactics Used by Fraudsters:

- Advertising fake properties at below-market prices.

- Demanding deposits or fees before any viewing.

- Providing fake tenancy agreements and disappearing once money is paid.

Legal Implications for Victims

Victims of rental fraud may face difficulties recovering their money and could find themselves entangled in legal disputes. Reporting incidents to Action Fraud is crucial.

How to Stay Safe

- Always insist on viewing the property.

- Check if the landlord is listed with a government-approved scheme.

How to Check if a Landlord is Legitimate in the UK

Resources and Tools Available

- Land Registry: Verify property ownership.

- Government Schemes: Check if deposits are protected under approved schemes like DPS, MyDeposits, or TDS.

- Online Reviews: Look for reviews about the landlord or their properties.

Importance of Due Diligence

Taking these steps helps protect your finances and ensures you’re dealing with a legitimate landlord. Always cross-check credentials and request proper documentation.

Emerging Trends in Property Scams

1. Unique Property Group Scam

The Unique Property Group scam involved a fraudulent company soliciting investments for luxury properties that didn’t exist. Investors were misled by fake brochures and forged documents.

Lessons Learned:

- Verify any company you plan to invest with through trusted financial and real estate bodies.

- Always question high-return promises with little substantiated evidence.

2. Abandoned Property Advisors Scam

Fraudsters pose as “advisors” offering to help sell abandoned properties. They trick homeowners into signing away ownership or demand excessive fees for services never rendered.

Prevention Strategies:

- Avoid signing documents without consulting a solicitor.

- Be wary of unsolicited offers related to property transactions.

- Report suspicious activity to the authorities.

3. Property Tax Scams

How These Scams Are Executed:

- Fraudsters impersonate HMRC officials, claiming unpaid property taxes.

- They demand immediate payment, often threatening legal action or property seizure.

How to Protect Yourself from Tax-Related Fraud

- Always verify communication directly with HMRC.

- Avoid sharing sensitive information over the phone or email.

- Report any suspicious activity to Action Fraud.

Conclusion

Property scams are a growing issue in the UK, affecting homeowners, renters, and investors alike. By staying informed, conducting due diligence, and reporting suspicious activity, you can protect yourself and your property.

At Zapperty, we pride ourselves on providing a transparent and secure process for selling properties quickly. If you need to sell your home hassle-free, get in touch with us today for a no-obligation cash offer. Let’s work together to create a safer property market for everyone.